Introduction:

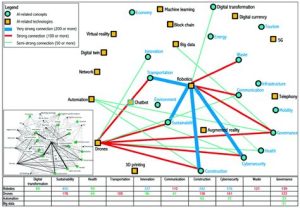

The rapid advancement of technology has led to the increasing integration of robots and automated systems into various sectors of the economy. As these machines become more sophisticated and prevalent, the need for a comprehensive framework to govern their deployment and taxation arises. In 2029, the Organisation for Economic Co-operation and Development (OECD) released guidelines on robot taxation models, aiming to address the challenges posed by the automated workforce. This article explores the key aspects of these guidelines and their implications for businesses and governments.

I. Background

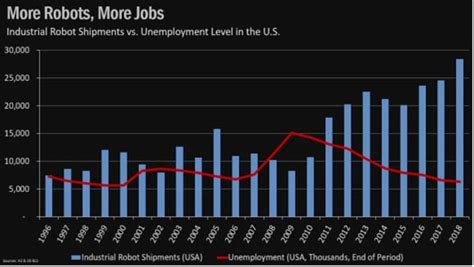

The integration of robots and automated systems has significantly transformed the labor market. While these technologies have led to increased productivity and efficiency, they have also raised concerns about job displacement, income inequality, and the need for fair taxation. Recognizing these challenges, the OECD established a group of experts to develop guidelines on robot taxation models.

II. Key Principles of Robot Taxation Models

1. Taxation of Robot Output:

The guidelines propose taxing the output of robots, similar to the way goods and services are taxed. This approach aims to ensure that the economic benefits derived from robot labor are appropriately captured by the tax system.

2. Allocation of Tax Burden:

The guidelines emphasize the importance of allocating the tax burden fairly between robots and human workers. This can be achieved by considering factors such as the value added by the robot, the level of human involvement in the production process, and the overall economic impact of the technology.

3. Exemptions and Incentives:

To encourage innovation and the development of advanced robotic technologies, the guidelines suggest providing certain exemptions and incentives. These measures should be designed to promote the efficient use of robots while ensuring that the tax system remains fair and equitable.

III. Implementation Challenges

1. Measurement of Robot Output:

One of the main challenges in implementing robot taxation models is accurately measuring the output of robots. The guidelines suggest using a combination of economic, technical, and statistical methods to estimate the value added by these machines.

2. Data Collection and Reporting:

Efficient data collection and reporting mechanisms are crucial for the successful implementation of robot taxation models. Governments and businesses must collaborate to establish standardized data-sharing platforms and ensure compliance with reporting requirements.

3. Legal and Regulatory Framework:

The guidelines recommend revising existing tax laws and regulations to accommodate the unique characteristics of the automated workforce. This may involve creating new categories of taxable entities or modifying existing definitions to reflect the evolving nature of work.

IV. Conclusion

The OECD guidelines on robot taxation models provide a valuable framework for addressing the challenges posed by the automated workforce. By implementing these guidelines, governments and businesses can ensure that the economic benefits of robotics are shared fairly and contribute to sustainable economic growth. As technology continues to evolve, it is essential for policymakers and stakeholders to remain vigilant and adapt these guidelines to reflect the changing landscape of work.